WHO WE ARE

We are early stage Venture Capital investors.

We are early stage

VENTURE CAPITAL INVESTORS

We love technology as a means to transform our planet for the better.

We believe in co-creating economic value together with the ecosystem we are part of.

Deep Ocean Capital (DOC) is our independent management company hosting our Venture Capital funds. DOC was born in Rome with international/global ambitions, and is focused on deep technologies.

Why Deep Ocean Capital? The Deep Ocean is the place on Earth that is less explored by humans, crowded with strange creatures, but also full of unexpected valuable resources. Likewise, Deep Ocean Capital has been established in 2021 to extract those resources present in abundance in the many folds of industrial and academic research.

Deep tech is the next global innovation wave. It will be the most disruptive ever. Deep Tech ventures will change the way we live and work, and more broadly the environment around us. Deep Ocean Capital through its VC funds will invest in those life-changing technologies and companies.

Governance

BOARD OF DIRECTORS

Our Team have strong and diverse skills in strategic and relevant areas, such as business and financial skills, with consolidated experience in Venture Capital, and technical skills in the domain of deep technologies, consolidated over many years of hands-on experience. As for the latter ones, the team has got a long-standing experience in IP-related matters, so crucial in patent-based businesses.

Board of Directors

DEEP OCEAN CAPITAL SGR S.P.A.

Domenico Nesci

CEO AND FOUNDER

Started early 2011 as angel investor in Italian Angels for Growth (IAG), where he made a few investments, leading the investors’ club deal for one of them and achieving one exit.

Joined LVenture Group where he has served in deal flow, and investment and monitoring capacities for several portfolio companies.

Emilia Garito

CHAIRMAN AND FOUNDER

Entrepreneur and a Tech Coast Angel Investor, a US West Coast angel investors group. Chairman and founder of Quantum Leap IP, a leading Italian company in Technology Transfer and Open Innovation founded in early 2011.

Innovation and Tech Transfer Expert for the European Commission’s Research

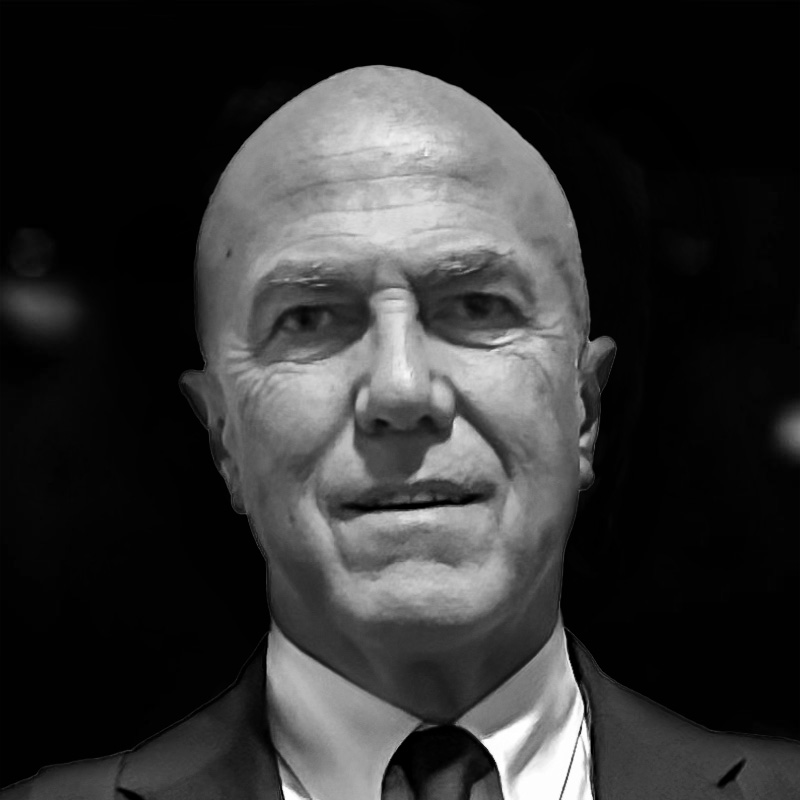

Paolo Cellini

Chief investment officer and Member of the board

Paolo Cellini is a professor of Digital Economy at the Faculty of Economics of Luiss and Luiss Business School and Professor of Ai economics at John Cabot University.

He is Chief investment officer of Deep Ocean capital.

Marco Simoni

MEMBER OF THE BOARD

Marco Simoni is a political economist with twenty years of experience in government, academia and management. He holds a degree in Political Science from La Sapienza University of Rome and a PhD in Political Economy from the London School of Economics and Political Science.

Alessandro Commito

MEMBER OF THE BOARD

Alessandro is currently responsible for Strategy & Innovation and Investor Relations at Directa SIM.

Previously, he was a Director and a Board Member of EnVent Capital Markets / EnVent Italia SIM, a distinctive investment banking firm dedicated to mid-sized clients, and before that he worked as a Director of Hub Innovazione Trentino.

BOARD OF STATUTORY AUDITORS

EXECUTIVE TEAM